Q4 2025 Investor Letter

- GROW Funds

- Jan 15

- 6 min read

Dear Investors,

Happy New Year! We hope you and your families are doing well.

We ended the year with a strong performance across your portfolios. Full year 2025 returns were +7% to +23% (net) across GROW managed portfolios versus the Russell 2500 Growth return of +7% and Russell 2000 Growth return of +12%. Please see disclosures for the historical performance data. As we enter the new year, we remain optimistic that our companies can continue to deliver positive fundamentals regardless of the economic backdrop. While the market can be volatile, we believe that the noise in the market will ultimately be eclipsed by the revenue and earnings growth our companies deliver.

Over 2025, we recognized capital gains by trimming when price targets were achieved or selling completely when our thesis changed. As the year progressed, we tried to offset any gains with losses as best we could but still had some taxable gains at year end. On balance, this turned out to be the right decision as many of the companies saw declines after we sold (Examples: XERS, GENI, NPCE, NTNX, SEMR).

We continue to have more high conviction ideas than capital to deploy. If you know of anyone who may be interested in our services, we welcome any introductions. Our hedge fund, for accredited investors only, was up approximately 175% net of fees in 2025. We are currently accepting new investors.

Market Summary

Interest Rate Cuts

The Federal Reserve lowered the Federal Funds Rate by another 25 basis points on December 10th. This cut marks the third cut in the last three fed meetings. Jerome Powell, the Chairman of the Federal Reserve, stated that “job gains have slowed, and the growth of economic activity has moderated” while “inflation has moved up and remains somewhat elevated.” From our perspective, this cautious tone leaves the door open for more cuts through the first half of 2026, which should be positive for stocks. Historically, small companies have typically outperformed during rate cutting cycles. While interest rate cuts could be a tailwind, the individual companies we own aren’t dependent on them to continue to perform well.

Healthcare Positioning

While we remain optimistic about the outlook for rate cuts, we acknowledge that stocks have had another good run during 2025. Over the last few years, we have rotated from being overweight in technology, then industrials, and have now shifted the portfolios towards an overweight in healthcare which is both offensive and defensive. Offensive in that these companies have new products (devices, drugs, diagnostics), addressing large market opportunities and defensive in that they are nondiscretionary and less economically sensitive. Pharmaceuticals, in particular, are an area we are positioned in to take advantage of novel therapies that address large market opportunities (see holding of AXSM highlighted below, and others include XERS, INDV, FENC).

Tariff Tantrum

In our Q2 letter, we discussed the tariff situation and the impact it had on the companies in your portfolios. In April, we had only witnessed the first derivative effects of the “tariff tantrum” and saw how they negatively impacted the market. During that time, we focused on the fundamental impact of tariff policies and how each of our companies was minimally impacted. This was well documented in our April letter where we viewed at worst, tariffs as a 1-time price increase, not a systemic inflationary force.

Artificial Intelligence

In our last letter, we discussed the “magnificent 7” stocks which have had a tremendous run. Much of the performance has come from investment in AI infrastructure and training models (see Cap-ex trends below). Companies like Microsoft, Meta, Amazon, and Google have invested hundreds of billions of dollars into these projects with the hopes of “winning” the AI race. The outcome of these investments is still unknown, and we have yet to see the “killer app” that demonstrates a high return on investment.

Recent partnerships like the one signed by Oracle, Nvidia and OpenAI remind us of the telecom boom and the dot com era in which Cisco started to provide vendor financing to its customers. This practice created a false sense of revenue growth which ultimately unraveled. The benefits of AI are undoubtably going to increase productivity, but over the longer term, the capabilities may be less than what is expected today. We are more focused on companies that are using AI to improve their business models.

Sentiment and Valuation

As we have discussed in prior letters, there remains a valuation discrepancy between the Magnificent 7 at 28 times earnings, the S&P 500 Index at 22 times earnings and the S&P 400 Midcap and S&P Small Cap indexes at 16 times and 15 times respectively (see charts below).

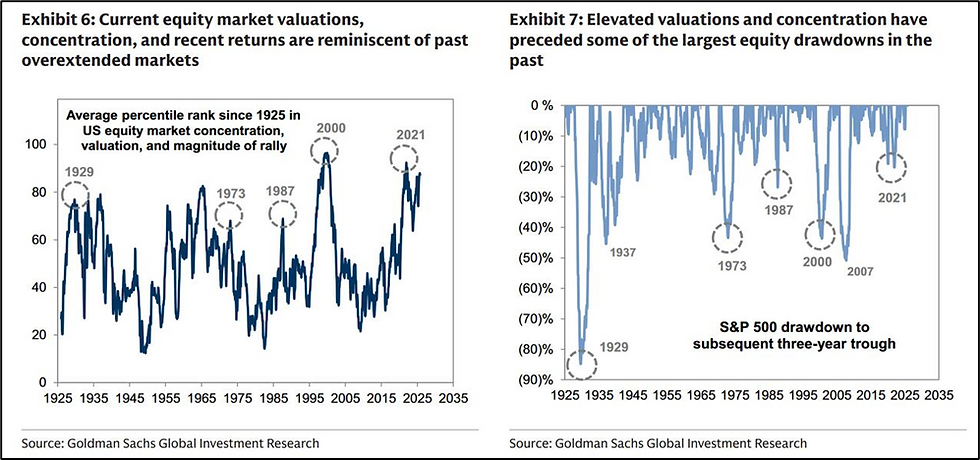

While some of this valuation differential is justified by the growth and earnings power of these companies, we believe that part of it is due to passive investing in market capitalization weighted indexes in addition to money creation at the Fed. While these trends remain in place, valuations are at levels last seen in 2000 and 2021 (See chart below).

Interestingly, market sentiment is in the neutral range as can be seen below in CNN’s Fear and Greed Index. Recall, that just last April, the index was at extreme fear and in June it was at extreme greed. This gauge tends to be a contrarian indicator which is why we remained confident in a rebound in April.

Portfolio Review

Contributors

Mama’s Creations (MAMA) was a strong performer for the portfolio throughout 2025. MAMA markets, manufactures, and distributes ready-to-eat deli style packaged food products. Their products include beef meatballs, turkey meatballs, beef meat loaf, sausage and peppers, chicken parmesan, and other similar meats and sauces. Shoppers are increasingly looking for ready-to-eat food options at grocery and convenience stores with a focus on cleaner, protein items with simple ingredients.

We originally purchased Mama shares at $2.50 and $3.50 and added more at $7.00 and $11.00 per share. The company has a new CEO, Adam Michaels, who has previously worked at Mondelez International, one of the largest food companies in the world. Since Adam joined the company in September of 2022, the management has improved multiple operational processes within the business, driving margins, and growth. Mama’s has over 45,000 product placements in Whole Foods, Costco, Sam’s Club, Albertsons, and Safeway. Mama’s has historically focused on the Eastern U.S. grocers for their products but now sells nationwide and recently won national product placements in Walmart, Target, and Costco, all of which could be $100 million customers over time. The company's management thinks they can achieve their $1 billion revenue goal in 2030, up from the $170 million in revenue expected in 2025. Mama currently has revenue capacity of $400 million. This figure increased in November when they acquired a company called Crown I Enterprises, located only 10 miles from Mama’s current manufacturing facilities. Crown was acquired from Sysco and sells similar chicken/beef products to grocers nationally. We believe the acquisition of Crown gets Mama’s in the door with retailers such as Trader Joes and may present a cross-sell opportunity for Mama’s other products.

In December, Mama’s Meatballs were advertised in the national mailer for Costco for the first time. We expect this to drive accelerating revenue growth in Q4 and beyond as new consumers try Mama’s products for the first time. We continue to hold Mama’s in investor portfolios.

Axsome Therapeutics Inc. (AXSM) was a new addition to investor portfolios in January of 2025 and has been a positive contributor since. Axsome is a biopharmaceutical company focused on central nervous system conditions such as Alzheimer’s Disease Agitation, Major Depressive Disorder, Migraines, and Fibromyalgia. Their products target a broad range of serious conditions that impact over 150 million people in the United States. Axsome has 4 products commercially available today with 2 others in late stages of approval. These products have the potential to provide over $16 billion in peak sales in comparison to Asxome’s $630 million of revenue in 2025.

Auvelity is an oral drug used for the treatment of major depressive disorder (MDD). It was approved by the FDA in August of 2022 and has quickly ramped to over $500 million in sales in 2025. Axsome has filed for a label expansion to Alzheimer’s Disease Agitation on Auvelity during Q4 2025. The FDA responded by giving Axsome accelerated review for their submission, a rare feat in the pharmaceutical industry. This happened on December 31st (shown in the chart above). We believed that Auvelity could reach $2 billion in peak sales for Alzheimer’s Disease Agitation alone. We expect an approval for this indication by mid-year, providing an upcoming catalyst for the stock. The company could also be an attractive acquisition candidate for a larger pharmaceutical company. We continue to hold AXSM stock in investor portfolios.

Detractor

MDxHealth (MDXH) is a prostate cancer diagnostics screening company we initially purchased at around $2 per share a year ago. Prostate is the second most diagnosed cancer type overall and the most common in men. Their portfolio includes Exo DX, Confirm mdx, Genomic Prostate Score (GPS), and the hereditary prostate cancer test. The company has a network of over 7 thousand physicians and has completed over 250 thousand tests in total. With their series of non-invasive tests, they offer physicians and patients additional guidance when making treatment decisions. MDXH had grown revenue each of the last 12 quarters at over 20% through Q2 2025. We believe this trend will likely continue and may actually accelerate that rate as they recently acquired an additional prostate test. The stock drop in November was due to confusion around their 2026 growth expectations which we believe was overdone. Despite the positive momentum the stock only trades at 2x EV/Revenues vs. peers at 5-9x for similar growth and margin profiles.

Outlook

We continue to see tremendous investment opportunities in the market. In addition, we believe that the current environment provides an opportunity for stock selection and active management versus passively investing in indexes. By continuously screening for companies with new products and services, large market opportunities and high revenue growth with strong margins, we believe your portfolios are well positioned. While we are cautiously monitoring macroeconomic events, our time is best spent looking for new ideas and re-evaluating your portfolios.

We thank you for your continued trust and support. We encourage any questions or comments you may have. As always, we are available for portfolio reviews anytime. Please contact us if you are interested in learning more about the companies you own.

Best regards,

Comments