Q2 2025 Investor Letter

- GROW Funds

- Sep 4, 2025

- 5 min read

Dear Investors,

We hope you and your families are doing well.

We ended the first half of the year with a strong rebound in performance across your portfolios. Second quarter 2025 returns were +17% to +23% (net) across GROW managed portfolios versus the Russell 2000 Growth return of +12% and Russell 2500 Growth return of +11%. Please see disclosures for the historical performance data.

As we enter the second half of the year, we remain optimistic that our companies can continue to deliver positive fundamentals regardless of the economic backdrop. While the market can be volatile, we believe that the noise on the political front will ultimately be trumped by revenue and earnings growth. We hope to have more positive updates through the remainder of 2025.

Market Summary

Tariffs

In our last letter, we discussed the positives and negatives of tariff policies. We disagree with tariffs from an economic freedom perspective, but since our last letter many countries have come to the negotiating table to continue trade with the United States. We believe this is good for both sides, and this will ultimately bring more foreign investment to the United States.

Tax Cuts and Private Sector Dominance

The Trump Administration’s “Big Beautiful Bill” recently was passed into law, which included an extension of the 2017 tax cuts. Tax cuts result in higher cash flows to both individuals and businesses. We believe that individuals and businesses can spend money in a more productive manner than the government. More capital in the hands of individuals and businesses will ultimately result in more spending and investment, which is good for the economy.

Government Spending

On the other hand, the Big Beautiful Bill increased the debt ceiling by $4 trillion dollars. As the government spends beyond its means, deficits and government debt accumulates, and money creation (the primary cause of inflation) is used to plug the holes. By increasing the debt ceiling the administration is continuing the trend of overspending and undermining the moves to reduce the deficit by $1 trillion annually. The result of this overspend is a loss of purchasing power for citizens.

Sentiment and Valuation

Interestingly, market sentiment is in the extreme greed range as can be seen below in CNN’s Fear and Greed Index. Recall that just in April, the rating was extreme fear at a score of 3. This gauge tends to be a contrarian indicator which is why we remained confident in a rebound in April. We are also realizing some gains and repositioning your portfolios as well.

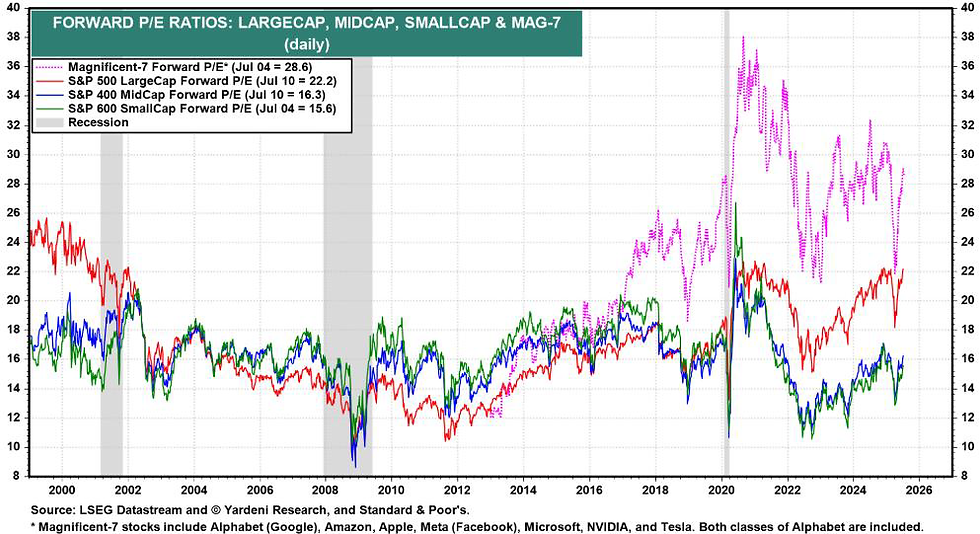

Valuations remain elevated for the magnificent-7 relative to the rest of the market (shown below). Small and mid-cap stocks are trading for 16x earnings, considerably cheaper than the large and mega-cap stocks.

Conclusion

To conclude, we witnessed the first derivative effects of the “tariff tantrum” and how they negatively affected the market. Deals have been made, and negotiations are ongoing. Moving forward, lower regulation, lower taxes, and lower inflation will ultimately increase cash flows for businesses who will hire more employees and invest for the future. While there is uncertainty in the broader macroeconomic landscape we are laser focused on how the companies in your portfolio are handling these challenges.

Portfolio Review

Contributors

Alpha Cognition Inc. (ACOG) is a pharmaceutical company who’s lead drug ZUNVEYL was approved by the FDA in July 2024 for Alzheimer’s disease treatment. This drug is only the second oral therapy approved and significantly reduces the nausea, vomiting and insomnia side effects which are common with other competitive Alzheimer’s treatments. Alzheimer’s affects 7 million people in the U.S. with 55% of patients discontinuing treatment within a year due to severe side effects. The initial target market represents over $2 billion in sales potential. The drug is targeted at patients with mild-to-moderate disease and aims to improve cognitive function and slow the progression of Alzheimer’s. The management team has a strong track record of over 140 commercial drug launches completed to date. With a market cap of only $175 million we believe there is significant room for appreciation. We purchased ACOG around $5.75 per share and continue to hold in client accounts.

Orion Group Holdings Inc. (ORN) provides specialty marine and concrete construction and engineering services in North America and Pacific regions. Management is confident in the $16 billion pipeline they have, up from $3b when management joined two years ago. This pipeline should result in larger orders and a growing backlog in 2025. There are multiple multi-billion-dollar Navy RFPs for China deterrence in the Pacific that represent transformative opportunities. Orion recently won a $435 million Pearl Harbor dry dock (the largest construction project in Navy history) and we think outstanding RFPs such as the $8 billion Hawaii Multiple Award Construction Contract (25% addressable by ORN) and the $15 billion Pacific Deterrence Initiative PDI-MACC RFP (50% addressable) as well as other opportunities represent transformative catalysts for the company. The US Navy is committed to improving their dry dock and port infrastructure in case of global conflict and few contractors are able to complete work of this scale. Separately, Orion’s concrete segment builds concrete foundations for data centers and other large buildings such as Costco. They are working on 29 projects, up from 24 last quarter and have 14 more in the pipeline. Projects can range from $5-10 million (foundations) to $50-60 million on larger projects. ORN trades at 8x EV/EBITDA vs peers at 10-15x. We think Orion will continue to grow at 20%+ for years to come and we see a path to a $12+ stock over time.

Aeluma Inc. (ALMU) is a semiconductor company that specializes in high-performance optoelectronics and electronic devices. They focus on developing innovative technologies for sensing and communication applications, using compound semiconductor materials Indium Gallium Arsenide on large-diameter silicon substrates. This approach enhances performance and scalability, making their products suitable for various industries, including mobile, automotive, AI, defense and aerospace, AR/VR, quantum computing, and communication. We purchased the stock at $5.25 per share.

Detractor

CVRx Inc. (CVRX) is a medical device company that manufactures and distributes devices for the treatment of heart failure. These patients are typically out of breath from basic everyday tasks such as walking up stairs. The CVRx’s Barostim device delivers electrical pulses to the baroreceptors located in the wall of the carotid artery which helps balance the signals of heartbeat sent to the brain. This improves the heart’s ability to send signals properly and improves patients’ quality of life. The next catalyst for the stock is a permanent reimbursement decision expected in October of this year. Currently, the CVRx device charges a temporary reimbursement code which it has used for the last few years. The company has new management with experience at Abbot and Medtronic. Johnson & Johnson is the largest shareholder of the company and owns ~19% of the shares outstanding. This market is worth $2.2 billion in the U.S. annually, of which CVRx makes up about $65 million today. The company missed expectations for the 1st quarter due to a company led salesforce realignment. We sold CVRX for tax purposes but still like the company longer term.

Outlook

We continue to see tremendous investment opportunities in the market. In addition, we believe that the current environment provides an opportunity for stock selection and active management versus passively investing in indexes. By continuously screening for companies with new products and services, large market opportunities and high revenue growth with strong margins, we believe your portfolios are well positioned. While we are cautiously monitoring macroeconomic events, our time is best spent looking for new ideas and re-evaluating your portfolios.

We thank you for your continued trust and support. We encourage any questions or comments you may have. As always, we are available for portfolio reviews anytime. Please contact us if you are interested in learning more about the companies you own.

Best regards,

Comments