MarketWatch Taking Notice

- GROW Funds

- Sep 8, 2025

- 4 min read

Updated: 6 days ago

This morning GROW was featured in an article published by MarketWatch. It's a short read that has some insight into our investment philosophy and a couple good quotes from Carl Wiese. You can find the link: How one hedge fund investing in small caps surged 25% in July and doubled this year - MarketWatch

How one hedge fund investing in small caps surged 25% in July and doubled this year

By Jules Rimmer Published: Sept. 8, 2025 at 5:56 a.m. ET

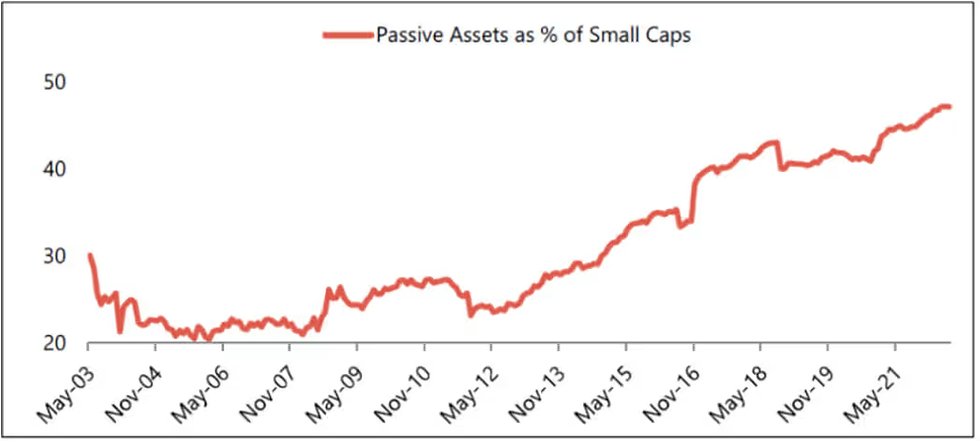

While large-cap megatech stocks have dominated the investment landscape in recent years, there’s one hedge fund specializing in small-caps whose performance has been outstripping most of them this year.

Grow Funds’ small-cap fund delivered a resounding 25% monthly return in July. And August was almost as good. At the end of last month the fund was up 96% so far this year, against just 7% for the broader Russell 2000.

Since inception, Grow’s Small Cap long/short fund (generally it uses index shorts as its preferred hedge) has returned 17% while the Russell 2000 RUT index is up 9.96%. The results are all the more impressive considering Grow rarely invests in companies with market capitalization exceeding $5 or 6 billion, meaning that the FAANGs and Mag7 MAGS stock market darlings are not on their radar and have not been included in their portfolios.

When asked what’s been behind the stunning performance over the summer, portfolio manager Carl Wiese doesn’t attribute it to just one big winner but rather contributions from several positions. Some clearly contributed more than others, however.

For example, semiconductor play Aeluma ALMU has quintupled this year. AI-marketing cloud provider, Zeta Global Technology ZETA, has also chipped in significantly. Despite screening north of a thousand stocks on a daily basis, Grow maintains a relatively concentrated portfolio, generally containing less than three-dozen names. Wiese has done the research: “Once you exceed twenty or thirty names in the portfolio, most of the benefits of diversification start to diminish.”

That strong returns can be produced from small cap stocks should not be that surprising. Looking at charts of the main asset classes – small cap, large cap, bonds and gold – over the last hundred years, and inflation, it is small caps that lead the way with an annualized return of 11.78%.

There is no secret or magic trick behind the success: Grow’s investment philosophy is straightforward and in some ways, old-fashioned. Wiese, who established the La Jolla, Calif.-headquartered fund in 2012 with fellow manager Michael Collins, is very candid: “We are stock pickers.” Wiese has been in the small-cap game for three decades, and Collins five.

The stock picking strategy is about identifying undiscovered, early-stage companies with above-average revenue growth, high profitability potential, and responsible management teams. However, the first criteria Wiese and his analyst Chase McIntosh examine when screening stocks are essentially technical: they look at price charts and accumulation metrics to measure buying and selling pressure.

After pinpointing interesting ideas, the disciplined process of analysis starts and will generally involve in-depth discussions with sell-side analysts and company management especially by which Wiese sets great store. Wiese provides the example of Steve Singh, founder of Concur, as an example of a business founder whom he successfully backed with an investment for thirteen years from 2003. Concur was acquired by SAP in 2014 for $8.3 billion.

While small-cap valuations can be inefficient because they are not followed exhaustively by Wall Street, they can be acquisition targets, have more focused business models and more often than not, exhibit better growth prospects, he says.

Wiese is confident that the performance can be sustained because, as the Fed enters what looks like a concerted easing cycle, small caps tend to outperform when interest rates are falling.

Small-caps tend to be more highly leveraged and therefore highly susceptible to fluctuations in their borrowing costs and any economic stimulus tends to be felt more rapidly on smaller balance sheets. Similarly, Wiese points out that with fewer international shareholders than large-cap stocks, his sector tends to be less vulnerable to the capital outflows that might have been triggered by the new trade and economic policies of the White House.

Wiese is less concerned about valuations than he is about growth but he emphasizes that despite frothy markets and relatively high stock market valuations at present, small caps can still flourish. He cites the examples of the period following the Nifty Fifty speculative frenzy in the 1970s and the dotcom bubble of the early 2000s and points out that small caps went on to outperform in the aftermath of both bubbles bursting.

Jules Rimmer

Jules Rimmer is a markets reporter in London. Rimmer spent more than 30 years as a trader and stockbroker in financial markets, starting at Salomon Brothers in the Liar's Poker era, taking in ING Barings, Jefferies and ending it in emerging markets at Investec. He hung up his headset and pivoted to journalism in 2021.

Comments